Security That Builds Member Trust

Purpose-Built Protection for Credit Unions.

In today’s financial landscape, cybersecurity isn’t optional — it’s mission-critical. Our Managed Security Services are designed with credit unions in mind, combining deep industry knowledge with cutting-edge technology to help you stay secure, compliant, and resilient.

With TorchLight, your credit union gains enterprise-level cybersecurity without the enterprise-level cost. We bring the technology, expertise, and 24/7 protection you need—so you can focus on serving your members, not fighting off cyberattacks.

Clear Visibility Into Risk

You can’t protect what you can’t see

We give your team complete clarity into your threat landscape — across devices, users, cloud platforms, and third-party vendors. Our tools identify gaps before they become breaches and provide clear, actionable insights instead of overwhelming you with noise. No guesswork. No blind spots.

Outcome: Smarter decision-making, proactive risk reduction.

Speed to Detect and Respond

Because delay is the enemy

The faster you detect, the faster you contain. Our platform continuously monitors your environment and flags threats in real time — backed by automated response workflows and a 24/7 expert team. Whether it’s a phishing attempt or unusual account behavior, we stop threats before they disrupt your business or compromise member data.

Outcome: Reduced threat dwell time, minimal operational disruption.

Confidence in Compliance

Stay ahead of auditors, not behind them

Meeting NCUA, FFIEC, and GLBA standards shouldn’t feel like a fire drill. We embed compliance into your day-to-day security operations, with detailed logs, clear reporting, and built-in controls. Whether you’re prepping for an exam or responding to findings, you’re ready.

Outcome: Streamlined audits, reduced regulatory exposure.

Security That Evolves With You

Designed to scale as your institution grows

From core conversions to new digital services, your technology stack is always changing — and your security should keep up. Our solutions adapt to your credit union’s size, complexity, and future plans without needing massive overhauls or extra headcount.

Outcome: Long-term agility, future-ready protection.

What Makes Us Different?

TorchLight emphasizes collaboration amongst all stake holders. It’s a key component of our internal culture and we aim to ensure we can proactively identify hidden risk, empower employees and create a superior banking experience for your customer

TorchLight Services

24/7 Monitoring & Active Incident Response

Protect your credit union around the clock with continuous threat monitoring and expert-led incident response. Our security team watches your environment day and night—ready to investigate alerts, contain threats, and respond swiftly to minimize disruption. Ensure business continuity, safeguard member trust, and stay ahead of evolving cyber risks with proactive, always-on protection.

Endpoint Detection Response & Identity Threat Detection Response

Safeguard your members, staff, and sensitive financial data with real-time protection across all endpoints and identities. From teller stations to remote laptops, detect and stop ransomware, malware, insider threats, and credential abuse before they impact operations. Strengthen trust by ensuring only authorized personnel can access core banking systems and member information.

SIEM & Log Management with Compliance Reporting

Gain full visibility into your credit union’s IT environment with centralized log management and intelligent threat detection. Our SIEM solution streamlines compliance reporting for NCUA, FFIEC, and other regulatory frameworks—while helping you detect anomalies, investigate incidents, and meet audit requirements with confidence.

Regulatory Compliance & Risk Management

Stay ahead of regulatory demands and reduce operational risk with expert-driven compliance and risk management services. We help your credit union align with NCUA, FFIEC, GLBA, and other key frameworks—offering continuous risk assessments, policy support, and audit readiness to protect your operations and member trust.

Compliance-Ready. Threat Resilient.

Credit Union Secure.

Why TorchLight?

At TorchLight, our “why” is simple: we exist to serve our customers and protect them from the relentless threat of hackers. This mission drives everything we do, setting us apart in the Secured and Managed IT landscape.

We foster a culture of candor, transparency, service, proactive communication and a growth mindset, all aimed at supporting our clients’ needs. We seek trusted partnerships with organizations that share our values, prioritizing open dialogue and a win/win mindset.

Together, we ensure that IT security goals are not only met but exceeded, safeguarding business continuity every day. Our people are our greatest asset, unified by our mission to secure and serve our customers and frustrate the hackers.

The Way Forward – TorchLight Blog

-

The Windows 10 to Windows 11 Transition

Another large milestone looms in the Microsoft ecosystem as Windows 10 is (mostly) officially sunsetted on October 14, 2025. Meaning, no new security updates will be produced by Microsoft, unless you purchase an ESU/Extended Security Update license for up to three years that will allow Windows 10 to continue receiving security updates on a regular…

-

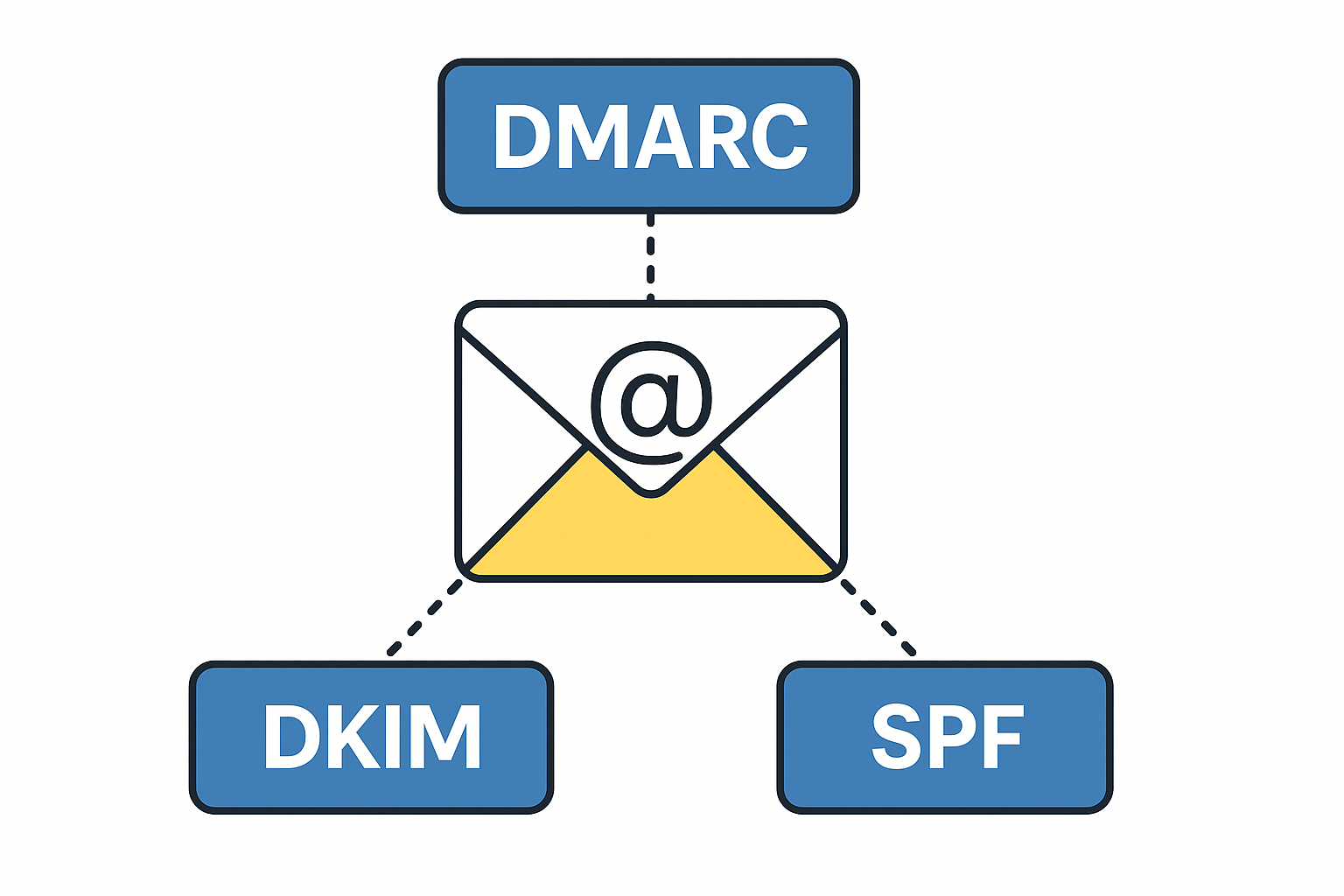

Tech Talk – What is DMARC, DKIM, SPF & Why Do I Want To Know?

DMARC, DKIM and SPF are three separate email authentication protocols that build layers of security around email delivery and integrity. Used in conjunction with each other, they provide a durable layer of protection for inbound emails and brand protection to prevent bad actors from sending emails using your business domain name. These tools provide domain…

-

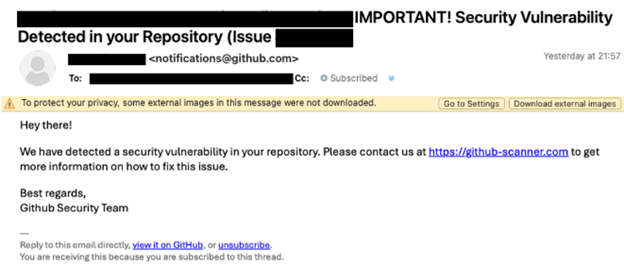

Beware of the ClickFix Scam!

TorchLight’s Threat Intelligence team has uncovered a resurgence of a phishing scam called ‘ClickFix,’ initially identified in late 2024 but now widely used by cybercriminals in 2025.